Israeli startup Xyte recently secured a significant $30 million investment, positioning itself at the forefront of the hardware-as-a-service trend. With the resurgence of this model, particularly in the face of mounting pressure on manufacturers’ margins, Xyte aims to capitalize on the success of software-as-a-service by applying it to hardware solutions.

Deck Overview

Xyte’s pitch deck consists of 27 slides, featuring redacted information related to customers and trading figures. While this approach ensures confidentiality, it also presents challenges in fully understanding the company’s profile.

Key Sections

- Cover slide

- Company overview and team details

- Opportunity assessment

- Market analysis

- Problem statement

- Value proposition and solution

- Traction and customer testimonials

- Business model and go-to-market strategy

- Financial forecasts and investment summary

- Closing remarks

Highlights

Opening Summary

Despite the overall underwhelming nature of Xyte’s deck, the opening summary slide stands out as a concise and informative introduction to the company. It effectively encapsulates crucial information, setting the stage for further exploration.

Comprehensive Summary

Xyte impressively integrates a second summary slide, reinforcing key points through the lens of an investor. This dual-summary approach enhances clarity and highlights the company’s strategic vision and market positioning.

Areas for Improvement

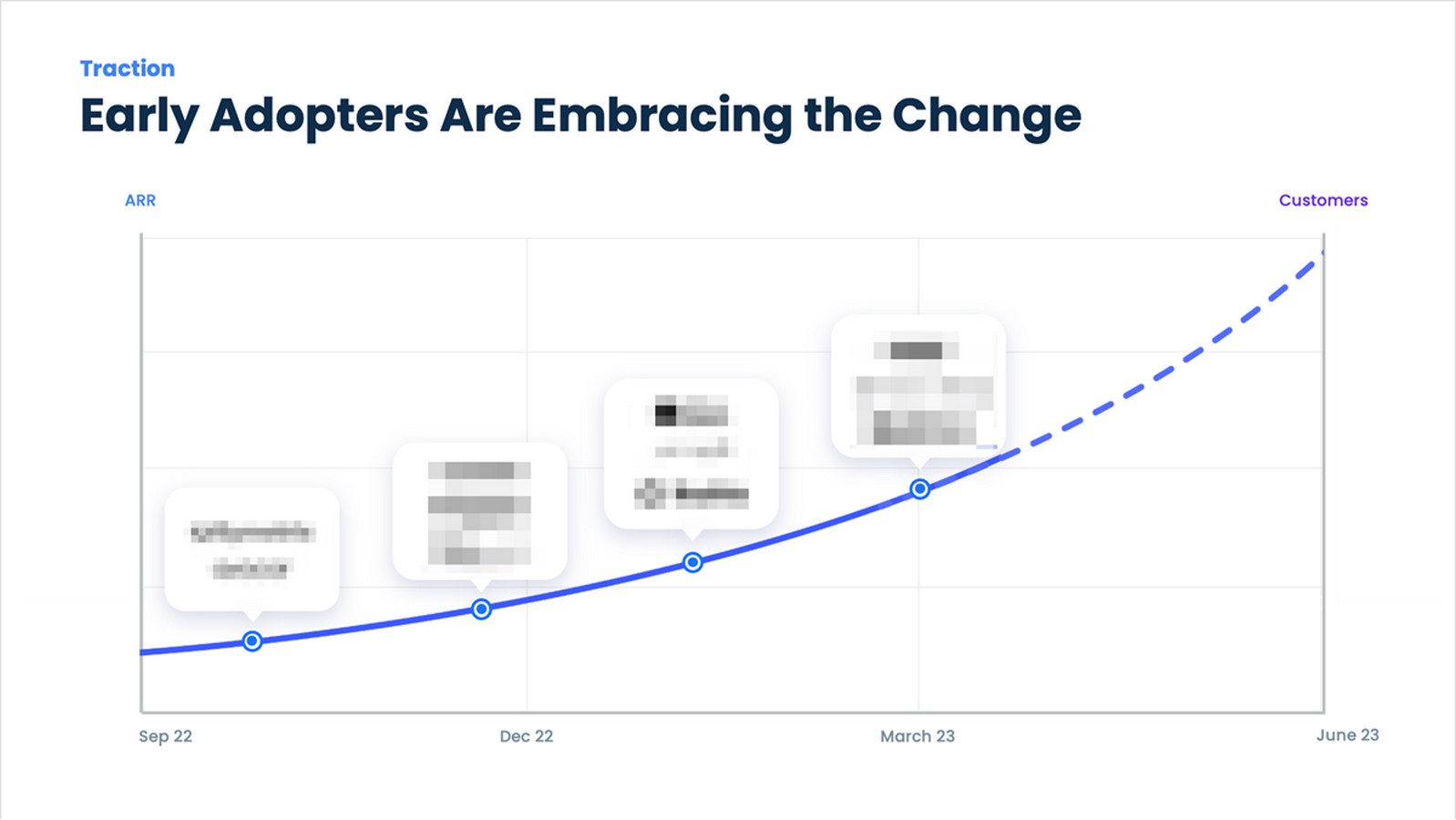

Illustrative Graph

Xyte’s use of an illustrative graph, lacking real data, undermines the credibility of the presentation. Transparent representation of milestones and metrics would bolster investor confidence and eliminate ambiguity.

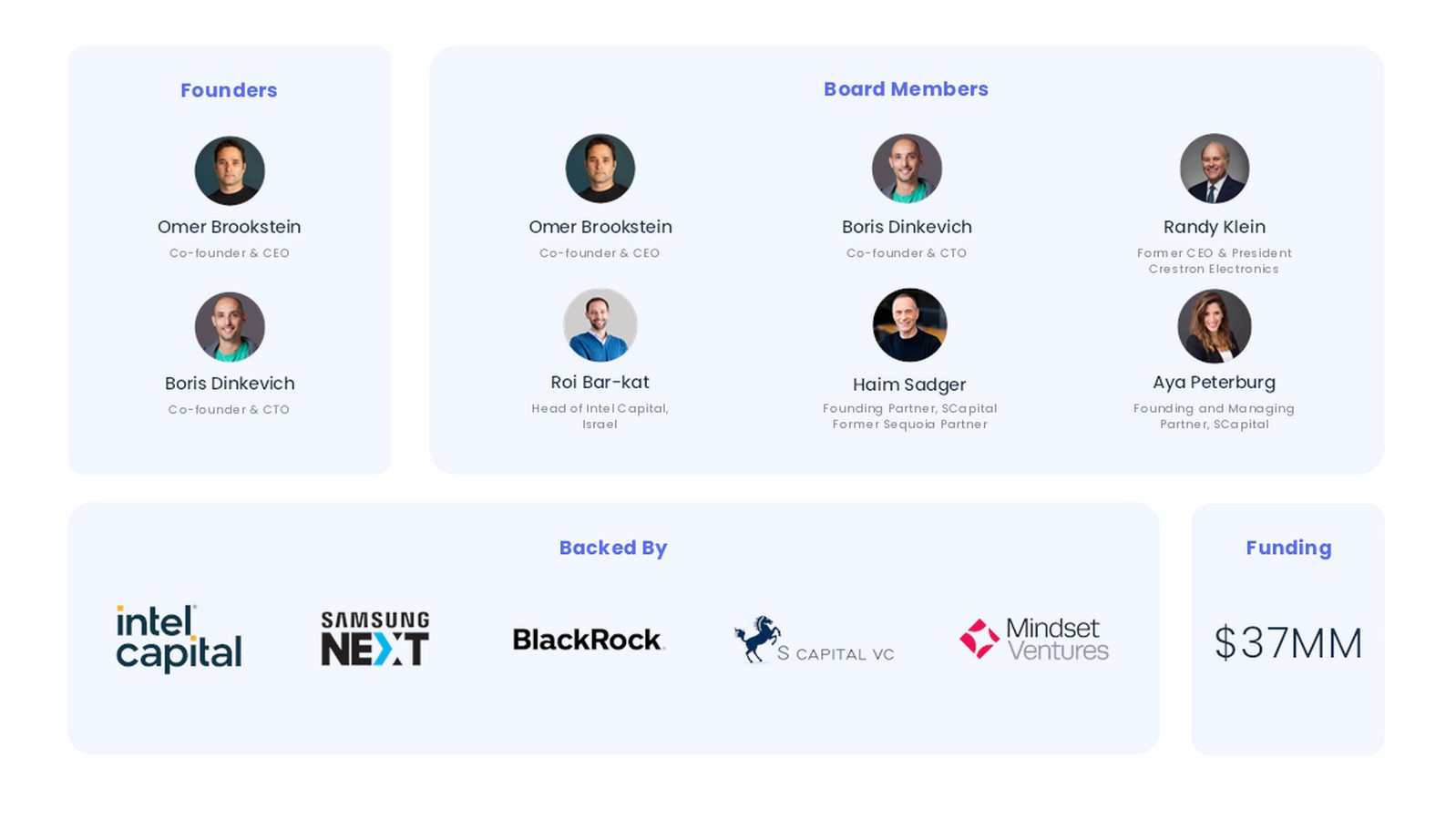

Team Presentation

The inclusion of two team slides, separated by a significant portion of the deck, fails to effectively showcase Xyte’s talent and expertise. To address this, Xyte should focus on highlighting the team’s competitive advantage and unique qualifications.

Go-to-Market Strategy

Xyte’s go-to-market slide lacks depth and specificity, falling short of providing a comprehensive understanding of its expansion plans. By incorporating detailed insights into target customers, acquisition strategies, financial projections, and scalability initiatives, Xyte can enhance investor confidence and clarity.

In conclusion, while Xyte’s pitch deck exhibits some strengths in its opening summaries, there is room for improvement in areas such as data visualization, team presentation, and go-to-market strategy articulation. By addressing these areas, Xyte can enhance the effectiveness of its pitch and attract greater investor interest and support.